does georgia have estate or inheritance tax

It hit its 40-year high of 92 in June and has. The State of Florida does not have an inheritance tax or an estate tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Homestead tax credit towards up to 1168.

. While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable. In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. Estate taxes are only mandated in a handful of states.

Georgia does not have any inheritance tax or estate tax for 2012. Wisconsin does have several tax credits available. Yet some estates may have to pay a federal.

For 2017 the Federal Estate and Gift Tax Rate is 40. What is the most you can inherit without paying taxes. Jusho means principal place of residence ie domicile by habitual residence The table assumes that the heir beneficiary is a US.

Yet some estates may have to pay a federal estate tax. Yes by Estate Gift Treaty. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets.

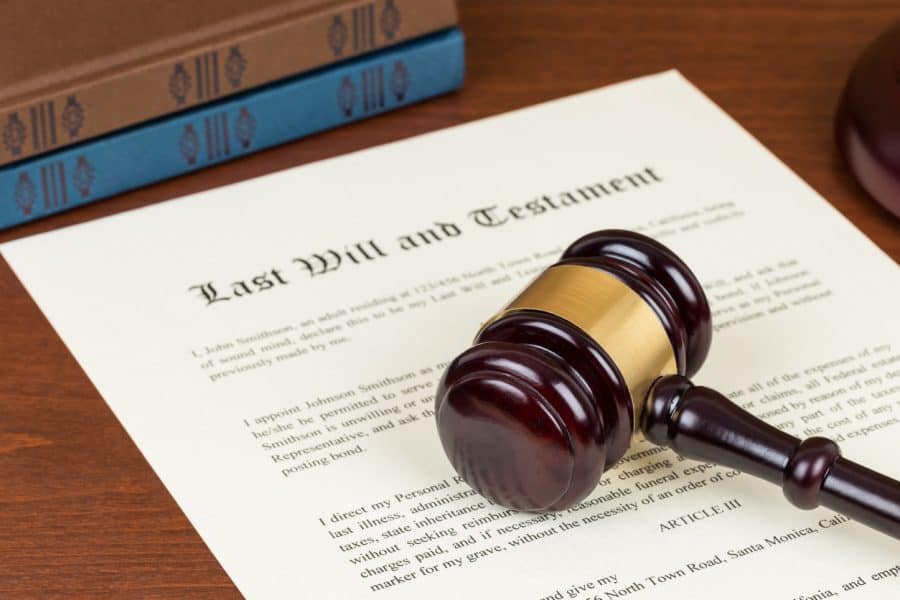

According to the Georgia Department of Revenue state legislature enacted the law that eliminated estate taxes on July 1 st 2014. Inheritance taxes also known as estate taxes are the taxes paid on the property left to the heirs of a deceased person. Does Sweden have estate taxes.

10 Does Sweden have inheritance. What do election results mean for interest rates. Does Georgia have an estate or inheritance tax.

11 How much does it cost to buy a house in Sweden. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The lifetime exemption amount for a Georgia gift or estate is 15000 for each giver and recipient.

The tax is paid by the estate before any. However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation. Whether youre an executor newly in charge of handling a complex estate left by a business owner or youre a.

Like the United States today Swedens estate tax rates were as. Understanding Georgia inheritance tax laws and rules can be overwhelming. For example an inheritance tax can be imposed on a monetary gift.

Earned income tax credit worth up to 13 of your federal earned income tax credit. Iowa is phasing out its. As of 2014 Georgia does not have an estate tax either.

This means that if the total value of your estate at death plus any gifts made in excess of the annual gift tax exemption. There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206.

Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. No Georgia does not have an inheritance tax. Inflation has continued to surge near 40-year highs over the past few months.

Gov Charlie Baker Optimistic About Nearly 700 Million In Tax Break Proposals Including Changes To Massachusetts Estate Tax Masslive Com

Tax Comparison Florida Verses Georgia

Here S How Settling An Estate In Georgia Work Faulkner Law

State By State Estate And Inheritance Tax Rates Everplans

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Georgia Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes Itep

Georgia Probate And Estate Administration Lawyer Scholle Law Personal Injury Lawyers

Utah Estate Inheritance Tax How To Legally Avoid

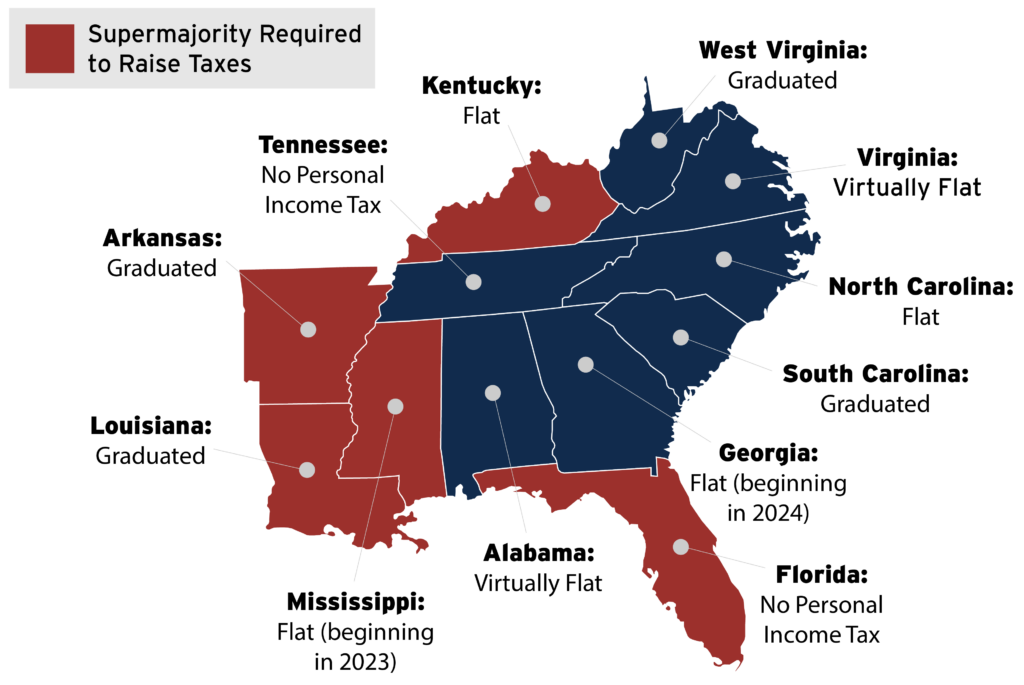

Creating Racially And Economically Equitable Tax Policy In The South Itep

Taxes That An Estate May Owe Brian Douglas Law

Worldwide Estate And Inheritance Tax Guide 2022 Ey Global

Do I Need To File A Tax Return On Behalf Of The Deceased And The Estate Brian Douglas Law

State Estate And Inheritance Taxes Itep

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

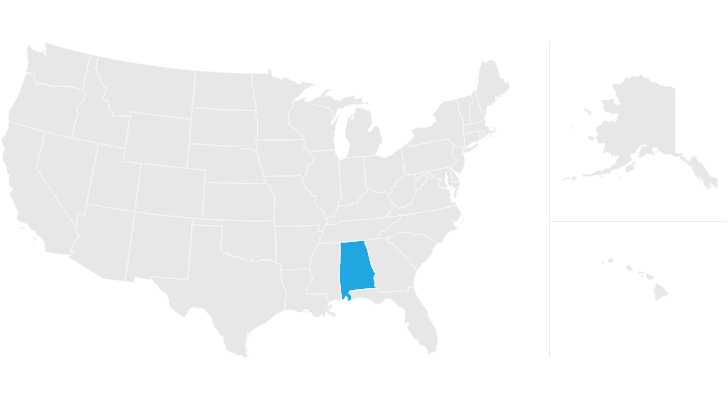

Alabama Estate Tax Everything You Need To Know Smartasset

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Guide To Georgia Inheritance Law The Law Office Of Paul Black